Fintech App Development Solutions for Enterprise

Fintech App Development Solutions for Enterprise and Startups

offer the best available solutions for any business that seeks them. In the past few years, Fintech has rapidly grown to earn a name, and almost every mobile application development company advises the exploration of Fintech in order to provide the best mobile app marketing strategy for a successful business.

These Fintech apps have made our lives easier in numerous ways. Often their commonplace nature makes it very difficult to identify them, owing to the frequency of their use. Simple actions such as banking, transferring funds, ordering food online, investing, calling for a cab, shopping and health-based transactions, all make use of fintech. In such a case, looking to develop mobile apps for your business with fintech as a determining factor, can only lead to its success.

Not only is its accessibility and economical ability in terms of time, effort and sometimes money, a factor that goes into determining its use, but also, mobile app development ideas for fintech companies are rapidly gaining precedence over traditional methods of conducting business. With the unfortunate advent of COVID19 as well as an increasingly digital market, it is very likely that it will only grow in the foreseeable future. This creates more opportunity for these mobile app development ideas to thrive, as they also gain more interest from investors.

With all of this in mind, we look at 5 Top Mobile App Development Ideas For Fintech CompaniesChallenges faced by Contact Tracing Apps

Successful Fintech Apps in Market

1. Payment Apps

In an era where social distancing is preferred, the anxiety around physical interaction is high, and most nations are going cashless to enable faster, seamless transactions- peer-to-peer payment apps are gaining precedence. This is simply due to the fact that lack in movement does not result in stopping of payments or transactions. Many people have turned to online payments, for which, the demand for such mechanisms/ interfaces that allow sale and buying of goods and services, has and will continue to increase. The demand for apps that allow users to send money to another account via their linked digital money, therefore, has and will continue to only increase. Account details, sending/ receiving money, Unique ID/OTP, Chat interface etc. can be incorporated within payment apps to make their functioning smoother and more adaptable

2. Wealth Management

Very often it pays (very literally) to have an app that can manage our investments and assets in synch with our everyday payment accounts. For somebody who has too much information to manage, this can make for a very helpful tool. Wealth Management is often a risky business, especially if one lacks the training or understanding for it. This app could help in tracking spending and creating a monthly budget to optimize investments. Account, asset classes or individual security can be given full attention along with some built-in mechanisms for diversification, risk management, and any hidden fees being paid. Similarly, comparing one’s portfolio to other significant market benchmarks can help in determining whether the app user is adequately meeting their investment goals.

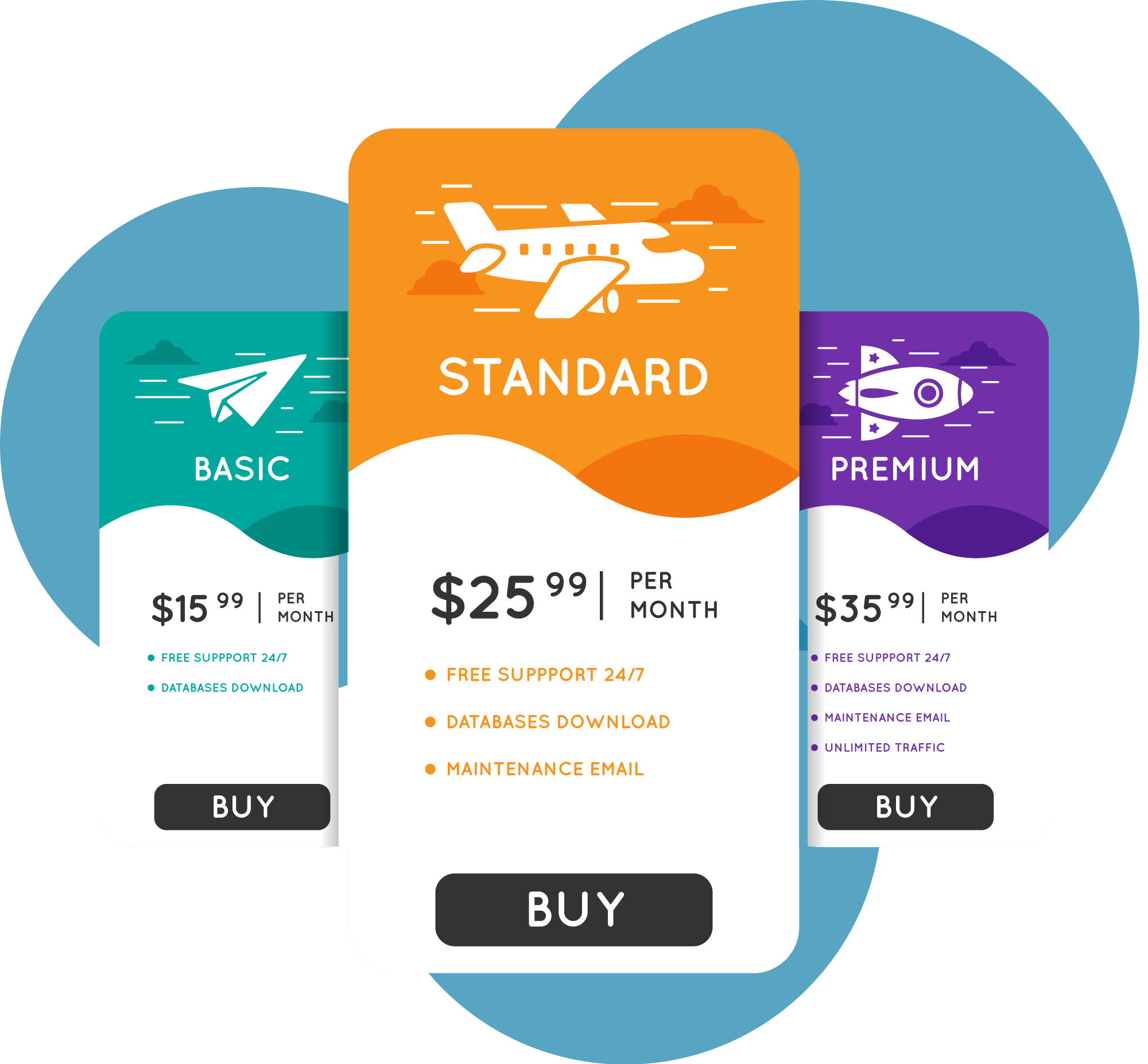

3. Subscription Management Apps

Gone are the days when mailboxes used to overflow and subscriptions used to be expensive. Nowadays with just a click, one can subscribe to any medium of their choice- ranging from magazines to e- newspapers. While this may be economical in terms of cost, the quantity can be just as difficult to manage, and contribute to a lot of digital space which can eat up on one’s available space. It could get very difficult to manage subscriptions, often when a tab is not kept from the very start as one goes about their business. To make things more manageable, Subscription Management Apps can be used. What this app can do entirely depends on the developer, but it can identify unused subscriptions by uncovering and cancelling them. It could also analyze spending behavior and give recommendations to improve financial health, make regular savings deposits and attach a goal to those savings.

4. Budgeting Apps

While the name may seem very similar to #3 Wealth Management Apps, there is a stark difference, in the sense that budgeting apps are more concerned with much more frequent transactions made by the user on a day-to-day basis. A built-in monthly expense tracker could help the user connect their bank account so as to import transactions and keep a tab on spending. Expenses can even be split between multiple budget items. It could keep more tabs that help in simpler tracking just after one glance, such as the amount spent so far for a specific month and the expendable amount that is left with the user. In addition to all this, a detailed breakdown of factors that contribute to the user’s credit score can also be provided.

5. Loan Payment App

An app that can keep track of the user’s loan payments is very effective as it offers a lending hand in systematising the amount of funds payable to the lender with less hassle or anxiety. Emergencies such as bill payments, medical bills, EMIs etc can be meted out to the app users. All they would have to do is add work and bank account information. The app can systematically deduct money after the user receives their pay-check in order to let them pay back easily. Other features such as no hidden charges/ fees, alerts and notifications about pending/ due payments, safe and secure means to protect bank details etc. can be incorporated to make the app much more simpler.

I-lanamtechnologies is a web development company in Canada that looks after your mobile app marketing strategy, mobile application development and your app development needs. We offer a wide range of services and cater to your customised demands in order to bring you the best IT solutions for a successful business. You can reach out to us at:#app development toronto

Let us help you transform your fintech idea to successful business through our IT services.

Give us a call or drop by anytime, we endeavour to answer all enquiries

within 24 hours on business days.